Hard Money Atlanta Can Be Fun For Everyone

Wiki Article

Hard Money Atlanta - Questions

Table of ContentsThings about Hard Money AtlantaRumored Buzz on Hard Money AtlantaGet This Report about Hard Money AtlantaThe Facts About Hard Money Atlanta RevealedHard Money Atlanta Fundamentals Explained

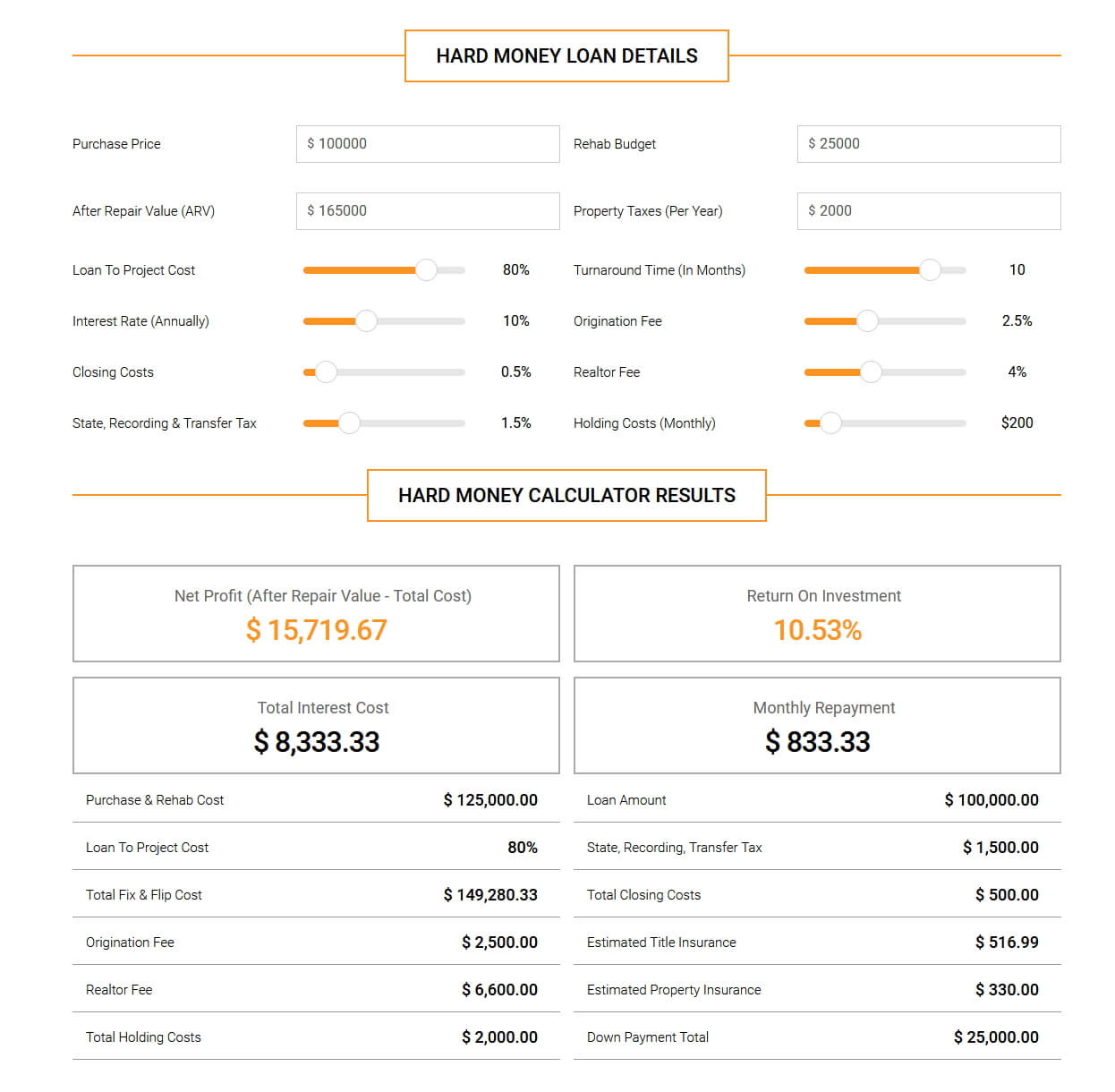

In a lot of locations, rates of interest on tough cash financings run from 10% to 15%. In addition, a customer may require to pay 3 to 5 points, based on the total financing amount, plus any appropriate evaluation, assessment, and also management costs. Several tough cash loan providers need interest-only repayments during the short duration of the car loan. hard money atlanta.Difficult money loan providers make their money from the rate of interest, points, and fees billed to the customer. These loan providers seek to make a fast turn-around on their financial investment, therefore the greater interest prices as well as shorter terms of hard money fundings. A difficult money car loan is a good idea if a customer needs money promptly to spend in a property that can be rehabbed and also turned, or rehabbed, leased and re-financed in a fairly short duration of time.

The Buzz on Hard Money Atlanta

For personal capitalists, the best part of obtaining a tough cash car loan is that it is simpler than getting a standard home mortgage from a bank. The approval process is typically a lot less intense. Banks can request a virtually unlimited series of documents and also take numerous weeks to months to get a funding accepted.The main purpose is to see to it the borrower has an exit approach and also isn't in economic wreck. But several tough cash loan providers will deal with individuals who don't have fantastic credit score, as this isn't their largest worry. The most vital thing hard money lenders will certainly consider is the investment home itself.

7 Simple Techniques For Hard Money Atlanta

There is one more benefit constructed into this process: You obtain a second set of eyes on your offer and one that is materially spent in the task's result at that! If a bargain is poor, you can be rather confident that a hard money lending institution will not touch it. You ought to never make use of that as an excuse to abandon your own due diligence.The most effective location to search for hard this website cash loan providers is in the Bigger, Pockets Hard Money Loan Provider Directory Site or your regional Realty Investors Organization. Keep in mind, if they have actually done right by another capitalist, they are likely to do right by you.

Keep reading as we talk about tough money fundings and why they are such an eye-catching choice for fix-and-flip investor. One significant advantage of difficult cash for a fix-and-flip investor is leveraging a trusted lender's trusted capital as well as speed. Leveraging means making great post to read use of other individuals's money for investment. Although there is a danger to funding an acquisition, you can maximize your own cash to acquire even more buildings.

The Main Principles Of Hard Money Atlanta

You can take on jobs incrementally with these calculated finances that permit you to rehab with simply 10 - 30% down (depending on the loan provider). Difficult cash lendings are usually temporary financings made use of by real estate investors to fund fix as well as flip homes or other genuine estate investment offers. The property itself is used as collateral for the car loan, as well as the high quality of the genuine estate offer is, therefore, extra vital than the consumer's credit reliability when receiving the lending.This additionally indicates that the risk is greater on these financings, so the rate of interest rates are usually greater too. Take care of as well as turn investors select difficult cash since the market doesn't wait. When the opportunity offers itself, as well as you prepare to obtain your task into the rehabilitation phase, a hard cash funding gets you the cash money straightaway, pending a fair analysis of the company bargain.

Ultimately, your terms will depend on the difficult cash lender you choose to function with and also your unique scenarios. The majority of tough money lenders operate locally or only in particular regions.

Excitement About Hard Money Atlanta

Intent and home paperwork includes your in-depth range of work (SOW) and insurance (hard money atlanta). To analyze the property, your lending institution will certainly look at the worth of equivalent homes in the area and their estimates for development. Following an estimate of the home's ARV, they will fund an agreed-upon percent of that worth.This is where your Scope of Job (SOW) enters into play. Your SOW is a file that information the job you mean to carry out at the residential or commercial property and also is normally needed by most tough money lending institutions. It consists of restoration costs, duties of the celebrations entailed, as well as, frequently, a timeline of the deliverables.

Let's think that your residential property doesn't have actually an ended up basement, linked here yet you are planning to complete it per your extent of work. Your ARV will be based on the marketed costs of comparable houses with completed cellars. Those rates are likely to be greater than those of residences without completed cellars, hence enhancing your ARV and potentially certifying you for a greater finance amount. hard money atlanta.

Report this wiki page